Why Growth Matters

Living in an economy that doesn’t grow is a terrible fate.

A lot of left-leaning people refuse to value the economic growth on its own. To many of them, growth is something negative. A poisoned concept used by capitalists to justify their terrible capitalist things.

“Why do we need more growth and isn’t it impossible a finite planet?” they ask. “Why can’t we just stay where we are and focus on helping people?”

Because living in an economy that doesn’t grow is a terrible fate. Growth and GDP aren’t some imaginary concepts that have no bearing on our lives. In fact, GDP correlates pretty well with happiness until around $70,000, where it plateaus (pretty late as you can see). GDP isn’t some fake number, it’s a metric of the economy which is produced by a multitude of value-creation processes where people produce and trade goods or services.

An economy that doesn’t grow means your employer’s company likely doesn’t grow (it’s very hard to do in a stagnant world). So your employer can’t promote you (unless somebody else leaves or retires). They can’t justify raising your salary. If the entire economy is like this, then people don’t have much money to spend, which prevents the growth in the first place.

In a stagnant economy it’s much harder to create new businesses. There’s no reason to innovate. Everything is in the perfect competition, which means minimal profits, which means, again, companies can’t spend those profits on better products or to lure better candidates. So everybody holds on to their job, as there are no incentives for employers to compete for the best people and pay higher salaries or provide better benefits.

This is why recessions are such a terrible thing. They are caused by cascading decreases of demand. Simplistically, let’s say a car factory sees weaker demand. It cuts orders to their own suppliers accordingly. If it gets too bad, they cut personnel too. Now a bunch of businesses have less work (so they cut orders to their own suppliers and lay off their own personnel). Thousands of people are without income. All of them try to save money, so they don’t buy new things, and the cascade goes on, creating a flywheel.

But a recession is about a contracting economy. What if it just stays stable?

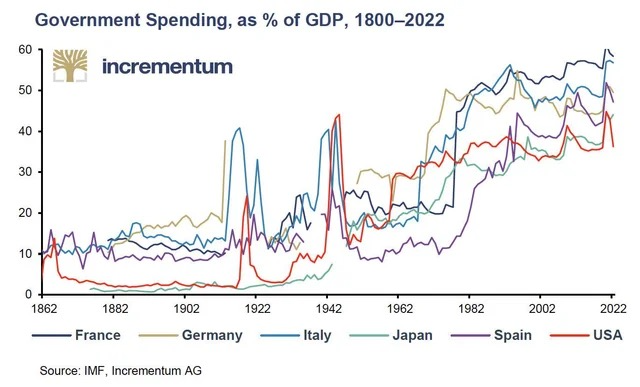

Even if your income is nominally the same, you will get hit by inflation. The inflation is primarily caused by governments running deficit and expanding the monetary supply. But the absolute majority of budget deficits in Western economies are caused by entitlement spending, primarily pensions and social benefits. With time, every society accumulates more obligations like this. Living standards rise, so pensioners demand higher pensions. People want better infrastructure built in safer ways, so the costs to create and support it go ballistic.

Nobody is ready to cut these obligations, so we’re stuck with this. These are promises made in the past that must be paid in the future.

Growth is how you make those promises affordable without fighting over redistribution. When growth stops, politics turns into a zero-sum game. Someone has to lose for someone else to win. Remind you of anything? This is the politics of 2020s.

The case against growth usually starts with a confusion between levels and rates. A rich country, the argument goes, is already rich. Why push for more? But growth is not about becoming rich once. It is about staying functional over time. A country with zero growth is not standing still. It is slowly losing the ability to deal with new problems. This is why the very term of “developed countries” doesn’t make sense. It’s not a club you have to only enter once. It’s the Red Queen paradox, where you have to run as fast as you can just to stay in place.

Ultimately, no country exists in isolation. Even if you’re satisfied with staying at the level (hypothetically), other countries will pull forward. And then your citizens will actually become poorer, because many things have the same price across the world, whether it’s cars or iPhones. Your best people will emigrate for the better opportunities abroad. Instead, rich foreigners will come to your country and buy up property inflating the asset prices, simply because they can easily afford it (unlike the locals).

And then, one day, British fans are outraged when they see the prices for the World Cup 2026 held in the US. FIFA is, of course, a very corrupt and money-hungry organization, but everything is more expensive in the US. They’re a big and wealthy country. This is why so many Americans go on a vacation in Europe. It’s much cheaper for them to fly to Chamonix for two weeks instead of going to Aspen. But this doesn’t work in reverse: American winter resorts would feel prohibitively expensive to an average European.

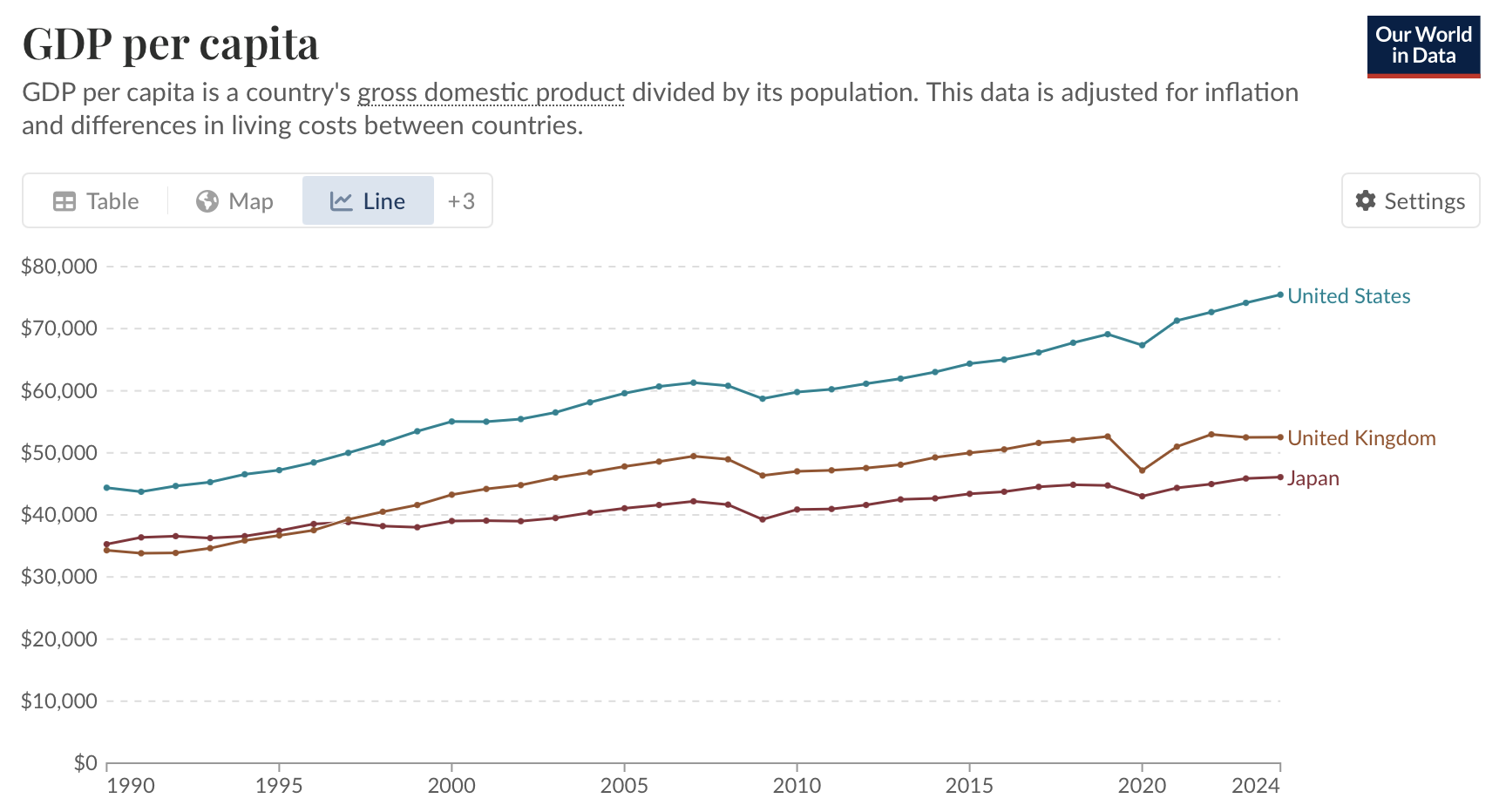

This is the story of the United Kingdom. It tracked other advanced economies, then fell into a long productivity slump after the global financial crisis and never fully recovered. Brexit slowed down trade and talent flows, compounding already weak productivity. Measured against the US, the median British household now earns significantly less in real terms than it would have if pre-2008 trends had held. You can see this in surveys: people feel they are working hard yet falling behind, public services is crumbling, and opportunities appear narrower than a generation ago:

When asked about the important issues facing the UK today, the most commonly reported issues were the cost of living (85%), the NHS (81%), and the economy (67%). Source

Did you hear how cheap Japan is right now from your friends? Or maybe read travel blogs saying just so? Well, it’s because Japan is kind of poor.

Their real GDP growth there averaged around 1% or less for three decades. Businesses avoided price increases, which leads to no wage growth, weak demand and creates a negative feedback loop. Japan feels cheap to people from other developed countries, but these countries are now expensive for the Japanese, along with the goods produced in there.

Economic growth is the best way to raise the quality of life for everyone. Sure, the outcome will not be evenly distributed: some people’s wealth will grow more than the others. People who only care about the inequality miss the forest for the trees. Ask yourself what’s actually important: the gini coefficient or the median quality of life? In my world, what’s important is that everybody’s wealth goes up.

The most dangerous idea is that stagnation is stable. But zero growth with constant change means eventual decline. Because technology does not pause. Other countries do not pause. Demographics do not pause. A country that decides it is fine to stop growing is making an implicit bet that nothing unexpected will happen. This rarely holds true.

***

But is infinite growth even possible on a finite planet? In all practical ways, it is. Even if the volume of resources is limited in theory, the amount of resources available to us is constantly growing. We’re constantly finding new deposits and new ways of accessing them.

Go read an old magazine and you might see scary forecasts that we’d be left with no oil by 2025. Similar forecasts are made about 2050 now. Turns out, oil companies are discovering just as much oil as we use each year.

When it was first discovered, aluminium was extraordinarily expensive and seen as a luxury metal. Napoleon III’s court prized aluminium tableware because it was rarer than silver. But in 1886 the Hall–Héroult process was developed. This breakthrough collapsed aluminum’s price, transforming it from a luxury metal into a mass-market industrial staple. Now we use it to make everything from planes to disposable Coca-Cola cans.

Some of the most valued objects on our planet are chips, CPUs and GPUs, which are made out of literal sand. Nvidia is a $4 trillion company because of how good they are at making chips (and they don’t even manufacture them, TSMC does).

We have gone past resources. Countries that sell nothing but commodities are usually considered poor, except a few lucky ones that have enormous oil reserves per capita. What matters is how much value can you add at each specific step.

The growth happens when businesses figure out new ways of building things that are more efficient and create new products. Human ingenuity can create value out of sand. And we have a lot of sand.