Startups comms, essays on tech and great curated links.

Posts tagged Tech

The AI Price Hike

Companies are bundling AI and raising software prices because they don't have a choice.

Retro Tech Became the New Luxury

People buy retro devices to feel control and do it so much they became luxury products.

How Big is TBPN?

Where I try to figure out how big TBPN actually is and why Big Tech CEOs come as guests.

The Broken Promises of Substack

Substack promised independence, but has evolved into another platform playing the same game as everyone else. The crab always becomes a crab.

How Much Spotify Pays Artists

Few things get people so worked up as Spotify's payouts to artists. Every time this topic comes up on Twitter or Threads, you can be sure there will be hundreds of angry replies from people you can't argue with.

The Limits of the Network State

I examine the practical limits of the Network State concept and its path to sovereignty as it clashes with the governments' monopolies.

I Can't Stop Using Dia Browser

Dia’s seamless AI integration and polished interface are redefining the browser for me.

Highlights from Apple in China

Patrick McGee’s book reveals how Apple’s unique manufacturing approach not only reshaped China’s tech industry but also left the company navigating a delicate geopolitical tightrope.

The Myths of Venture Capital

Venture capital didn’t kill Arc. It gave us the chance to see what Arc could be. That’s more than most products ever get.

Why I Don’t Like CarPlay

CarPlay is much better than what we had before, but I still prefer a great built-in multimedia. But only when they do this right (which is almost never).

WordPress Doesn't Matter for the Future of Web

WordPress won the market but the entire paradigm shifted to managed solutions like Webflow. Markets that aren't growing become a zero-sum game, which probably caused the conflict in the first place.

Why I’m Excited About Meta Orion

People like Orion because Meta had the courage to showcase it. We should stop giving Apple the benefit of the doubt.

Social Media Platforms Have Killed Links

When Facebook and Twitter started supressing links they forever changed the internet and we're still yet to grasp the outcome of this.

What Makes Telegram Special

Telegram is a a social platform with 1Bn users but few people in the West understand how advanced and powerful it actually is.

How Twitter Changed Since Elon's Takeover

Twitter released old products and built some new ones yet became much more toxic and lost a lot of its appeal to me.

What The EU Should Have Done Instead of DMA

The Digital Markets Act is a far-reaching framework that can be used against any major company the EU holds a grudge against. It also effectively prohibits product improvements and vertical integration.

The United Internet is Collapsing

The internet is one of my favorite inventions of all time. When nobody was watching, it emerged as a global network without borders, but now the governments are bringing them back with force.

Why Arc is The Best Browser

Arc reinvented web browsing for the modern Internet. And I’m very thankful.

Why Execution Eats Ideas For Lunch

Most people tend to overvalue ideas and undervalue execution. In my experience, that holds even for many people in the tech industry. Yet it couldn’t have been further from the truth. Let me tell you about a product that allowed you to easily create and manage your own relational databases together with your team members. It’s not Airtable but their early competitor.

The Unstoppable EU and The Immovable Apple

Apple is hell-bent on standing its ground against any attempts to limit their control over the AppStore. As a result, they might see governments worldwide legislating their product experience, and the result will likely be far worse both for them and their users.

Why AI Doomerism is Flawed and Misguided

The Internet favors simple opinions, meaning we're stuck between AI dommers and e/acc people. And yet the most urgent and interesting questions relate not to its potential capacity to kill us all, but rather mundane things.

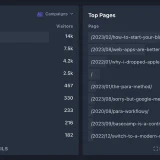

Does Blogging Even Work?

Blogging is still the most reliable way of broadcasting your thoughts without being at the whims of someone’s algorithm.

Why Superhuman Is Worth $30

I pay $30 a month for my email client. And I think it’s worth it because it’s excellent and there aren’t many alternatives, unfortunately.

Uber is Good, Actually

A conventional taxi is similar to a tourist-trap restaurant that you will never visit again. Uber leverages technology to become an arbiter between you and the collective of drivers so they can provide a better service.

Basecamp is a Contrarian Marketing Operation

Basecamp is well-known not because of its product but because its founders heavily leverage marketing and communications, eventually turning into contrarian marketing machines producing edgy posts and starting crusades just to get everyone’s attention.

Web Apps Are Better Than No Apps

There’s a certain community in tech that’s very vocal about their preference toward native apps. I share that sentiment, yet sometimes people take this idea too religiously. Unfortunately, the actual choice is about having an app or not, and I'd rather take something over nothing.

Sorry, But Google Meet Is Better Than Zoom

It seems that we're finally getting out of this weird period of collective gaslighting where people tried to convince everyone Zoom was the best conference app out there.

Facebook Went Meta, But Google Isn’t Alphabet

Google called itself Alphabet for corporate reporting purposes, Facebook rebranded to Meta because their business had changed.

Why Privacy Is Overrated

I’m not against privacy, and I understand why people might not want someone to track web pages or apps they use. But it’s important to remember that there’s a trade-off and be prepared for the outcome.

Why Algorithmic Feeds Can Be Good

People like to say they prefer chronological feeds to algorithmic ones. The actual problem is we rarely see good algorithms built to help us and not drive engagement. But I’d love to see a social network giving me tools to catch up on the people I care about.

Why Micropayments Don’t Work And People Hate Paywalls

Customers want micropayments but they're a bad option for news organizations. What they should do instead is provide us with better paywalls.

How Would Anti-Instagram Look Like?

Reading all those discussions about the updates to Instagram and how people are becoming disillusioned with the app, I began thinking: what would an ideal anti-Instagram service look like?

Crypto Preachers vs Crypto Skeptics

Social networks incentivize people to take on radical positions as that brings engagement and followers. Yet in most areas, a reasonable centrist take is usually the right one (there are exceptions of course). Crypto is certainly one of the most divisive topics both on Twitter and in real life.

Why Apple Has to Allow Sideloading

I think the lack of sideloading has been a tremendous advantage for iOS and Apple’s ecosystem. I also think Apple should give it already.

Browsers Are Outdated And Somebody Has To Do Something

Our browsers are astoundingly outdated and their developers seem to be oblivious to that. We went from basic HTML pages sprinkled with a little bit of Javascript to running full-scale applications like Figma or Descript yet browsers have practically the same UI as they had ten years ago.

A Controversial Opinion: Online Ads Are Good

One of my most controversial opinions is that online ads are actually great for the society and the public narrative shifting to paid subscription software, services and content might prevent a lot of people from accessing them in the first place.

How to Write Helpful Investor Updates

I've seen hundreds of investor updates and wanted to share the things I learned from them and how you can write a good one.

Google and the Paradigm Shift

The product that will dethrone Google Search won't be a search engine. Instead of links, it will simply provide you with answers.

The Evolution of Outliners

Outliners are apps which force you to write in hierarhical bullet points, helping you to structure your thoughts They are are a very curious category of software products that have been mostly used by a small number of geeks but recently captured more attention with the launch of Roam Research.

Superhuman and Premium Software

Superhuman with its premium pricing of $30 per month expands the Overton windows for apps pricing and has already enabled higher (and more sustainable prices) for new companies.